The economy may be under pressure and consumers may be spending less, but the outlook for franchising was never better, with increasing competition and the entry of new players expected to offer franchisees new opportunities. 2016 had increased activity within the franchise sector, particularly the fast food franchises.

The Franchise Association of South Africa (FASA)’s fourth independent survey undertaken among franchisors in order to assess the contribution by the franchise sector to the South African economy in terms of GDP, shows a business sector that continues to grow despite these fairly challenging economic conditions.

The most recent stats

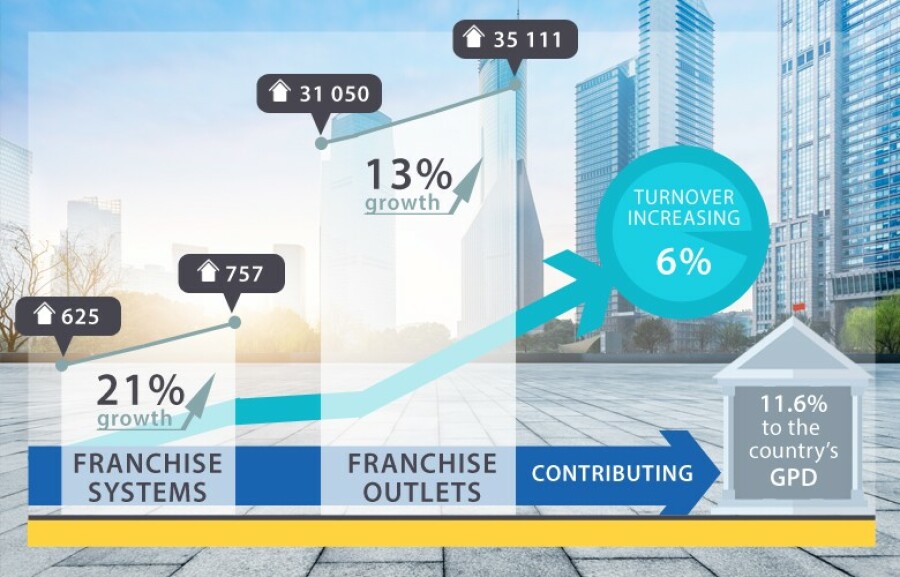

With an increase of 132 franchise systems from 625 to 757 (that’s a 21% growth), an increase of franchise outlets from 31,050 to 35,111 (a 13% growth) and with turnover increasing by 6% from R465.27 to R493.19 billion rand, the survey reflects both the successes and challenges facing this vibrant sector, according to FASA’s Chairman, Naas du Preez.

“Despite the downturn in the economy, the franchise industry continues to grow – although not quite at the same pace seen in previous years. The marked increase (21%) in the number of franchise systems and outlets (13%) could well be attributed to the inordinate number of new and international brands that have established themselves in South Africa over the past two years. This has not come with a concomitant increase in turnover (6%) however, which could be attributed to the lack of growth in the South African economy.”

The slow-down in turnover is supported by the fact that it appears to be taking a little longer for a business to break even, but the potential for growth remains strong with franchisors exhibiting an extremely high level of optimism and many are intending to expand their franchise system.

“What is without question,” says Du Preez, “is the tenacity of the sector, which refuses to remain static and shows great entrepreneurial spirit, contributing a healthy 11.6% to the country’s GDP.”

According to Vera Valasis, Executive Director of FASA, the survey, once again, has shown that franchising is one of the soundest business formats, structured to withstand economic challenges. “Despite the hard trading times over the past seven years, franchising has held its own year-on-year in every respect – from showing long-term sustainability to showing a high level of optimism for the future.”

What the franchise survey clearly shows is the franchise sector’s ability to identify the challenges and adapt to those changes. In this year’s survey, the poor economy, cash restraints and competitiveness were of greater concern to those surveyed. But, at the same time, they identified the importance of having the right franchisees and staff in place to retain and capture customers.

Sanlam, who sponsor the FASA Franchise Surveys, is able to track, through the survey, whether franchisors are incorporating financial planning as part of the franchise implementation process.

According to Kobus Engelbrecht, Marketing Head, Sanlam Business Market,

“it is encouraging to see that many franchisors have an eye to securing the future with one in three protecting the future of their franchises by incorporating financial planning and 70% having made provisions in case of ill health or frailty. What is of concern, however, is that the survey noted a marked decrease in addressing staff benefits.”

Growth and contribution of the sector

South Africa has over 757 franchised systems, just over 35,100 franchise outlets and 17 franchise business sectors. In 2016, there were a claimed 35,100 stores, most of which are owned by the franchisees (90%). This is an increase of 6% in the number of stores since 2014.

Franchise industries

According to the 2016 Franchise Directory, the largest franchise system is the Fast Foods and Restaurant category (27%). The Retail sector at 15% is the next biggest. Building, Office, Home Services (12%) and Childcare, Education and Training (11%) follow. Business to Business Services, Automotive Products and Services occupy 15% of the franchise market (8% and 7% respectively).

The other categories are 5% and smaller. The estimated turnover for the franchise market is R493.19 billion, which is 11.6% of the South African GDP. This includes the fast food and restaurant turnover but excludes that of the petroleum sector, where the turnover is pinned at R19.44 billion for the convenience stores and R200.72 billion for the forecourts.

Indigenous South African franchises

South Africa's top five home-grown franchises by their market share

Steers

The first Steers fast food outlet was opened in 1960 by Greek-South African entrepreneur, George Halamandaris, who got the idea for a steakhouse after holidaying in the United States.

Stats: According to Famous Brand's annual report, Steers has an 8% market share of the fast food industry and 18% of all burger brands. There are 522 stores in South Africa and 43 international stores.

Chicken Licken

Established in 1981, Chicken Licken's ‘Soul Food’ chain is the second largest fast food brand in South Africa behind KFC.

Stats: There are 247 outlets in South Africa and according to the Wall Street Journal, the food chain holds a 5% market share of South Africa's fast food market, tying with McDonalds. The journal also reports that Chicken Licken is the largest non-American-owned fried chicken franchise in the world.

Debonairs

Debonairs was founded in 1991 by varsity student, Craig Mckenzie, who started a small pizza delivery business.

Stats: Delivery turned out to be a smart move as Debonairs is now the number one pizza franchise in South Africa. There are 500 Debonairs stores in South Africa and according to the South African Customer Satisfaction Index released early this year, the franchise holds a 3.6% market share in the fast food industry.

Nando’s

Nando’s was started in 1987 by Portuguese-South African entrepreneurs, Robert and Fernando (He’s called Nando for short so hence the name).

Stats: The group has grown rapidly as SAcsi reports Nando's holding at 3.5% market share of the fast food industry. The chain's presence is not limited to just South Africa, they are on five continents around the world, with 1,000 outlets in 30 countries, and over 300 in South Africa. According to CNBC Africa, Nando’s is South Africa's most successful restaurant group export.

Spur

The Spur steakhouse franchise is a distinctly family-orientated brand, which was established over 40 years ago, and is recognised both locally and internationally.

Stats: According to Wall Street Journal’s market ratings, Spur is a market leader in the steakhouse arena. The restaurant holds a market share of 3.26% in the food industry with 479 outlets globally, 429 of which are in South Africa.